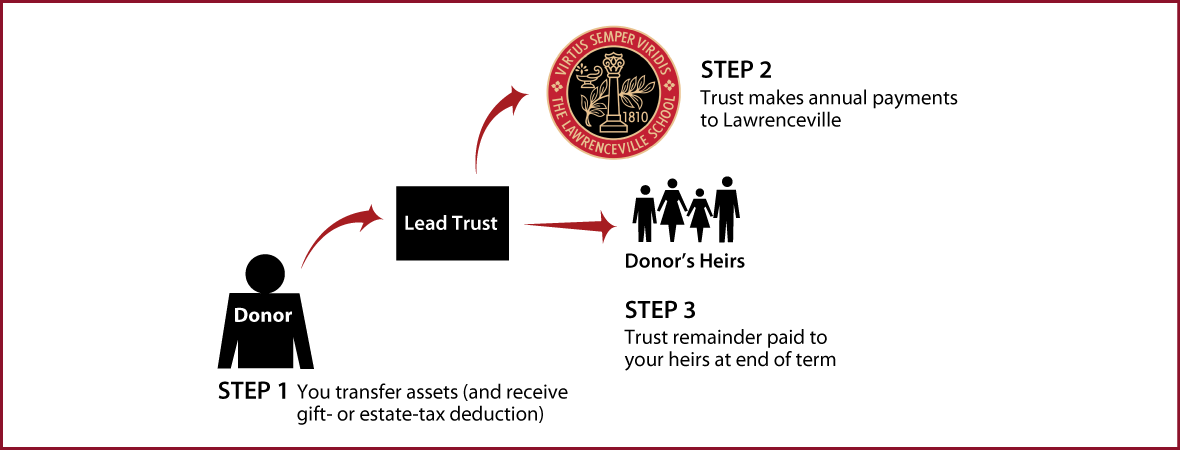

How It Works

- Create trust agreement stating terms of the trust (usually for a term of years) and transfer cash or other property to trustee

- Trustee invests and manages trust assets and makes annual payments to Lawrenceville

- Remainder transferred to your heirs

Benefits

- Annual gift to Lawrenceville

- Future gift to heirs at fraction of property's value for transfer-tax purposes

- Professional management of assets during term of trust

- No charitable income-tax deduction, but donor not taxed on annual income of the trust

Request an eBrochure

Request Calculation

Contact Us

Stephanie Truesdell

Director of Principal and Major Gifts

(609) 895-2182

struesdell@lawrenceville.org

Julia Ott

Director of Planned Giving

(609) 620-6064

jott@lawrenceville.org

The Lawrenceville School

P.O. Box 6125

Lawrenceville, NJ 08648

Tax ID No. 21-0634503

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer